The FBI states it’s a smart idea to deal with the keypad any time you enter your PIN to forestall any cameras from recording you.

The skimmer on the still left is free in the event you wiggle it. the image on the correct is how the pump really should look. resource: Kamloops RCMP

He remaining many click here good information in the comments to this submit, so we’ve collected it collectively beneath for less complicated accessibility.

Using your hand to cover the pad even though moving into your PIN will protect against anybody or nearly anything from observing your PIN and making use of it to obtain your account.

and become Specially vigilant when withdrawing funds to the weekends; robbers have a tendency to install skimming units on Saturdays after company hours — whenever they know the financial institution won’t be open yet again for greater than 24 hrs.

I’ve heard of this stuff but This is often the first time I ever saw a single, what Would you like me to do with it?” never to scare any person, but I’ve spoken to more than one law enforcement officer who may have stated, “Okay, what Are you interested in us to perform with it?”

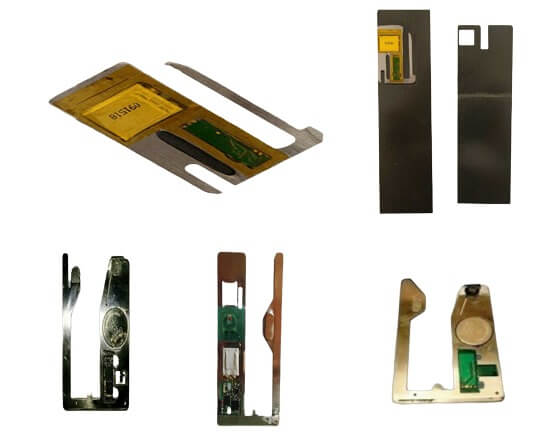

An ATM skimmer is a misleading system that thieves set up on ATMs to stealthily seize your card particulars and PIN. These unlawful gadgets are cleverly disguised as Portion of an ATM or issue-of-sale program.

Alfonso Barreno Betancort September 18, 2022 for nearly ten years in Europe, the old world, on account of EU-wide payment market regulation, the usage of credit cards’ magnetic strips has been phased out. just about every card incorporates a proximity chip that takes advantage of encryption to speak bi-directionally with the vendor terminal or ATM, playing cards are now not launched or swiped but waived for the RFID transceiver as well as holder needs to crucial in his pin to ultimately authorize the transaction.

Even if you do every thing suitable and go more than just about every inch of each payment device you face (Substantially on the chagrin of your people today behind you in line) it is possible to be the focus on of fraud. But get heart: provided that you report the theft to the card issuer (for credit cards) or lender (in which you have your account) immediately, you will not be held liable.

though chip cards give a more secure choice to classic playing cards, they're not foolproof. They shop dynamic data that improvements with each transaction, making it tricky for fraudsters to clone or copyright the card. even so, they might nonetheless drop victim to skimming In case the skimming product is sophisticated enough.

Despite developments in card security, including chip technologies, criminals have adapted with approaches like ‘shimming,’ so ongoing recognition and reporting of suspicious action are critical.

after your data is compromised, the criminals can use it to create unauthorized transactions or promote it over the black market.

Beware that often these applications provides you with “Bogus positives,” especially if you take place for being near wi-fi headphones or other Bluetooth very low Vitality equipment.

however, Despite having the extra layer of security that card chips introduce, theft even now occurs. To adapt to this new protection energy, criminals turned to card “shimming,” which is basically just a more Highly developed version of skimming.